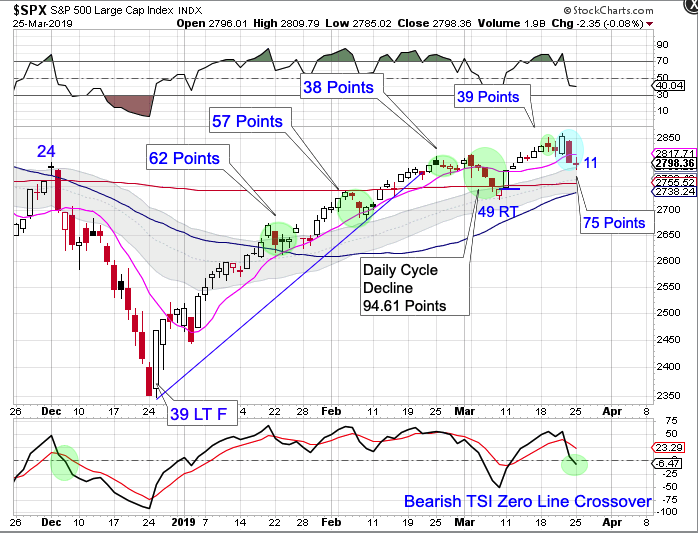

We noted on Saturday that aside from the March 8th DCL, we are starting to see a pattern of measured dips on the order of 40 – 60 points. Stocks were down 60 points at the close on Friday. For this bullish pattern to continue, stocks need to open higher on Monday. Instead, stocks broke lower.

Stocks were down 75 points Monday from Thursday’s intra day high, taking away the possible runaway move scenario. Stocks could be moving into an early half cycle low. Another possibility could be that the intermediate cycle is getting ready to roll over.

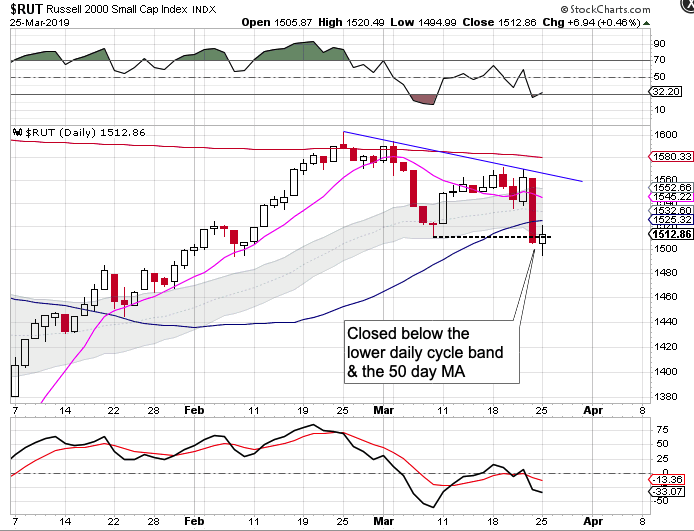

Notice that the Russell has formed a lower low that closed below the lower daily cycle band. That ends the daily uptrend and begins a daily downtrend for the Russell. And a daily downtrend is normally associated with an intermediate cycle decline.

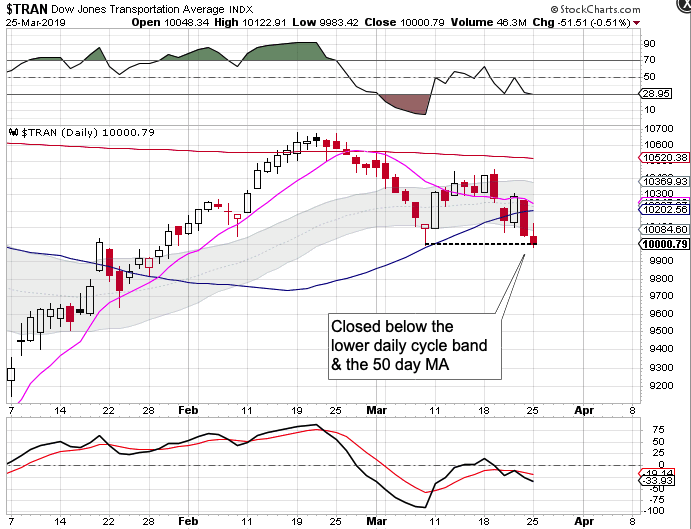

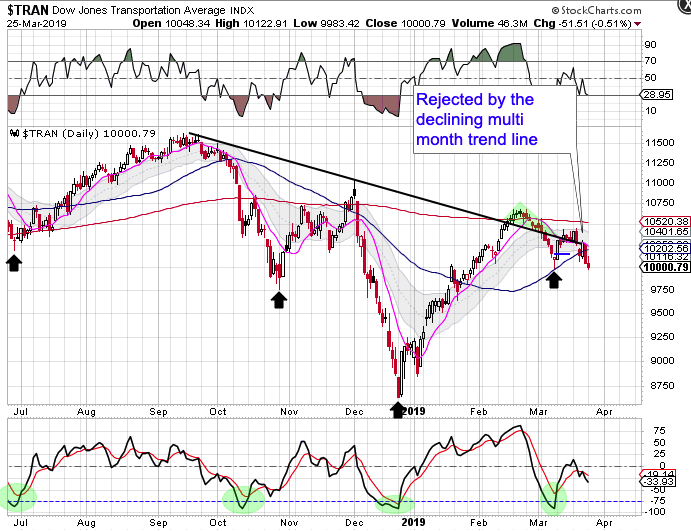

A similar concern is enfolding with the transports.

The transports have also formed a lower low that closed below the lower daily cycle band. That ends the daily uptrend for the transports and begins a daily downtrend.

The bigger picture for the transports is that the were rejected by the multi month declining trend line and closed below the 50 day MA. This looks more like an intermediate cycle decline instead of an advancing intermediate cycle.

Back to stocks.

Stocks are still above the 200 day MA and the 50 day MA. Stocks are also still in a daily uptrend. As long as a swing low forms above the lower daily cycle band, then stocks will continue with its daily uptrend and we would label the swing as a half cycle low.

But with the bearish concerns developing in the Russell and in the Transports, even if stocks do print swing low above the lower daily cycle band, caution going forward is warranted.