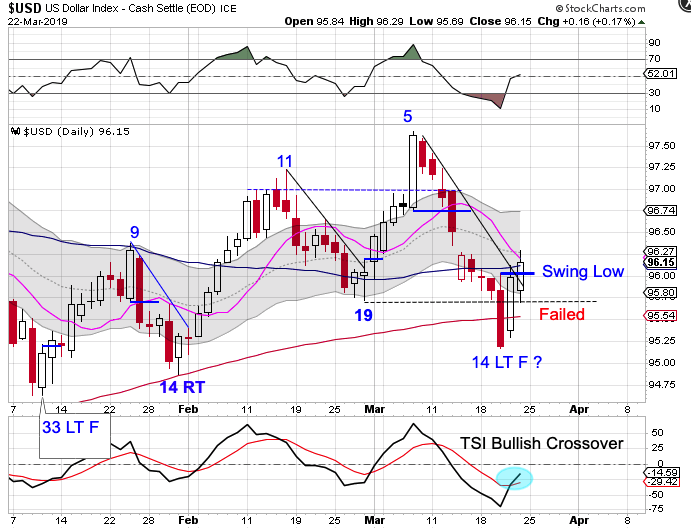

The dollar broke below the previous DCL on Wednesday to form a failed daily cycle.

The dollar also closed below the 200 day MA on Wednesday which signaled a continuation of the 3 year cycle decline. However, the dollar recovered the 200 day MA on Thursday, forming a daily swing low. Then delivered bullish follow through on Friday and regained the 50 day MA. A close above the 10 day MA will confirm that day 14 printed an early DCL. The dollar is in a daily downtrend. It will remain in its daily downtrend unless it closes above the upper daily cycle band.

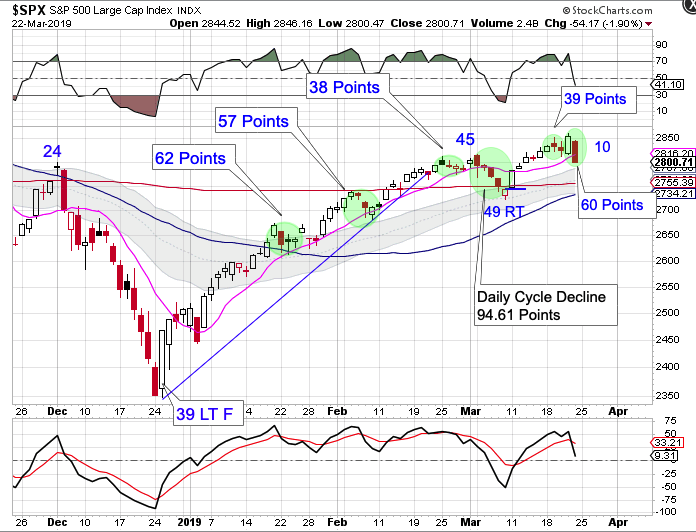

Stocks formed a swing high on Friday.

Aside from the March 8th DCL, we are starting to see a pattern of measured dips on the order of 40 – 60 points. Stocks dipped 60 points from the Thursday high to the Friday low. If stocks are entering a runaway market then stocks should recover on Monday. But of stocks continue lower that would disavow the runaway market scenario and indicate that stocks are declining into an early half cycle low. However, stocks continue to close above the upper daily cycle band, continuing their daily uptrend. They will remain in their daily uptrend unless they close below the lower daily cycle band.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.

You can email me at likesmoney@gmail.com to receive a sample copy of the Weekend Report