The Dollar

The dollar printed a bearish reversal on day 8 then delivered bearish follow through on Monday by closing below the converging 50 day MA and 10 day MA.

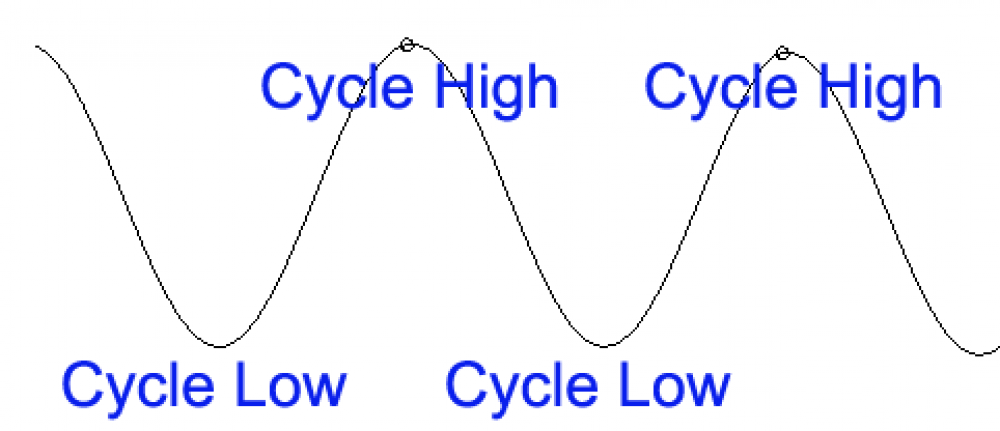

Closing below the converging 10 day MA and the 50 day MA on Monday confirmed the daily cycle decline. The dollar continue lower to close below the 200 day MA on Thursday. With a peak on day 8, closing below the 200 day MA looked like the dollar would be rolling over into an intermediate cycle decline. But then the ECB intervened — causing the dollar to close convincingly above the 200 day MA on Friday. While 13 days is too early to expect a DCL, the manipulation in the currency markets could force an early DCL. A break above 97.82 will form a swing low to signal the new daily cycle.

The dollar did close below the lower daily cycle band. That does end the daily uptrend and begin a daily downtrend. It also signals that the intermediate cycle decline has begun.

Stocks

Stocks formed a swing high on Friday and then delivered bearish follow through on Monday to close below the 10 day MA to signal the daily cycle decline.

Stocks printed their lowest point on Tuesday, following the day 39 peak. That was day 42, placing stocks deep in their timing band for a daily cycle low. A swing low formed on Wednesday. Then stocks closed back above the 10 day MA to confirm day 42 as the DCL. Stocks are currently in a daily uptrend. Stocks will remain in their daily uptrend unless they close below the lower daily cycle band.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.

You can email me at likesmoney@gmail.com to receive a sample copy of the Weekend Report