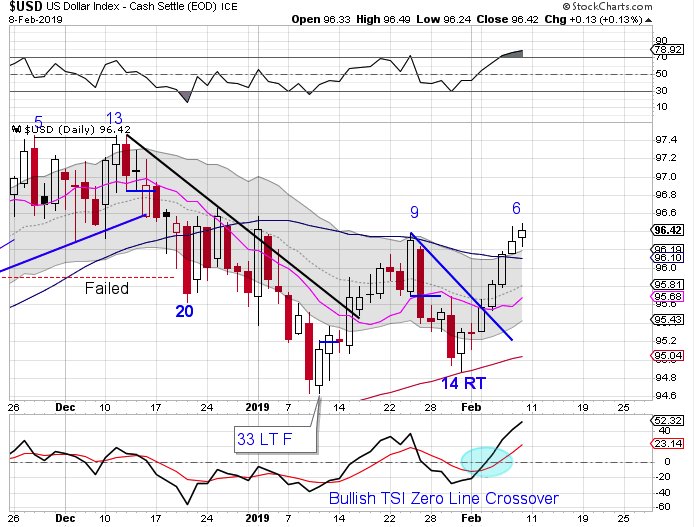

The dollar confirmed a new daily cycle.

The dollar has rallied off of support from the 200 day MA to close above the 10 day MA and turned it higher. It also managed to close above the 50 day MA confirming day 14 as an early DCL. Closing above the upper daily cycle band ends the daily downtrend and begins a daily uptrend. It also indicates the dollar has begun a new intermediate cycle.

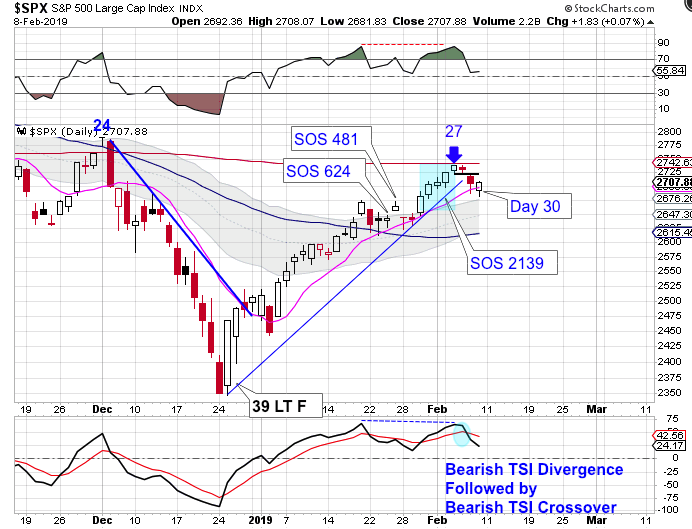

Stocks ran into resistance at the 200 day MA and turned lower.

Stocks formed a swing high and did break below the daily cycle trend line to indicate that the daily cycle decline has begun. Friday was day 30, placing stocks in the early part of its timing band for a daily cycle low. The over 3240 million in Selling on Strength prior to the daily cycle peak has me expecting a deeper correction. Stocks should close below the 10 day MA and turn it lower before printing its daily cycle low. But stocks printed a bullish reversal on Friday. If stocks form a swing low here that would trigger a cycle band buy signal. A close back above the 200 day MA would indicate that day 30 was a half cycle low.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.

You can email me at likesmoney@gmail.com to receive a sample copy of the Weekend Report