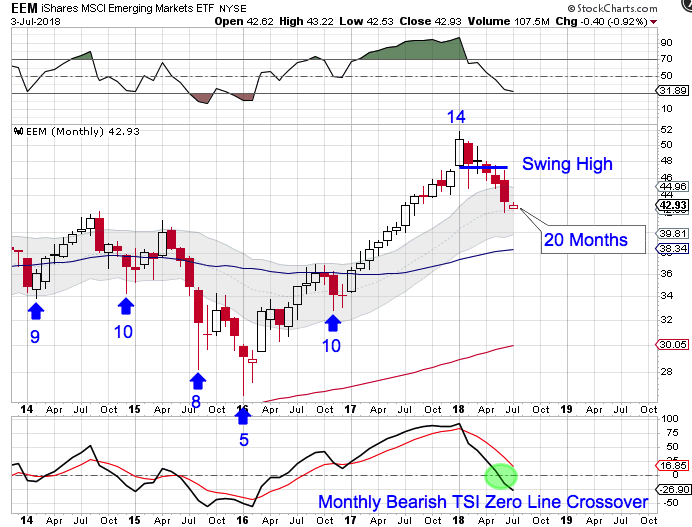

An opportunity is developing in the emerging markets.

The emerging markets (EEM) have been averaging a yearly cycle low every 9.8 months. EEM last printed a yearly cycle low on November, 2017. With July being 20 months since EEM last printed an identifiable yearly cycle low that makes EEM overdue for its YCL. EEM did peak in January, month 14, and has been in decline ever since. Once a new intermediate cycle begins, it will likely also mark the beginning of the new yearly cycle.

The emerging markets (EEM) have been averaging an intermediate cycle low every 21. weeks. EEM last printed an intermediate cycle low in February, 2018. This week makes it 21 weeks since EEM last printed an identifiable intermediate cycle low. Which places EEM in its timing band for an ICL. Once a new daily cycle begins, it will likely also mark the beginning of the new intermediate cycle.

The emerging markets (EEM) have been averaging a daily cycle low every 18.5 days. EEM last printed an identifiable DCL on May 29th. EEM printed its lowest point on Thursday, 6/28. At 22 days that places EEM in its timing band for a DCL. A swing low has already formed. A close above the 10 day MA will signal a new daily cycle. The new daily cycle should trigger a new intermediate cycle and a new intermediate cycle should also trigger the new yearly cycle.

Pingback: Another Look at Emerging Markets | Cycle Trading