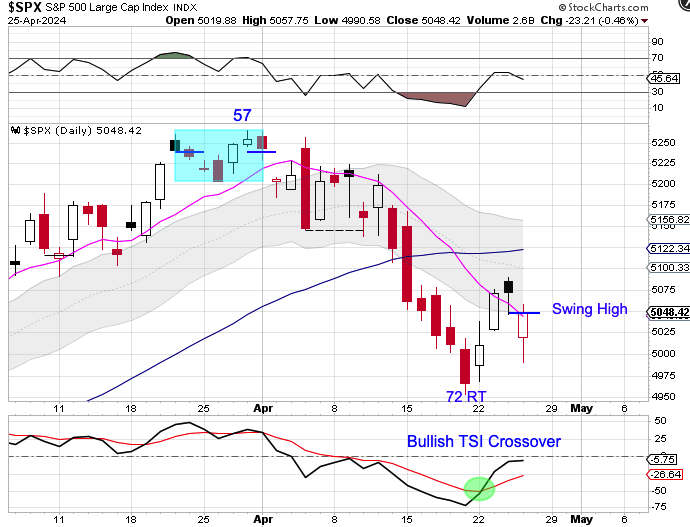

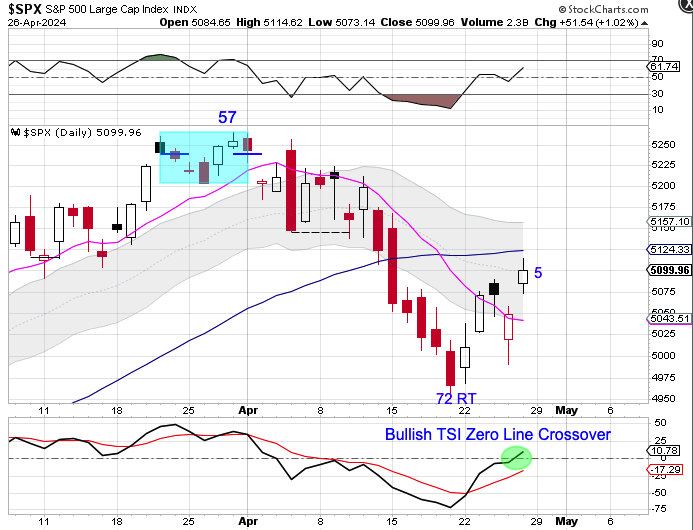

Stocks closed above the 10 day MA on Tuesday.

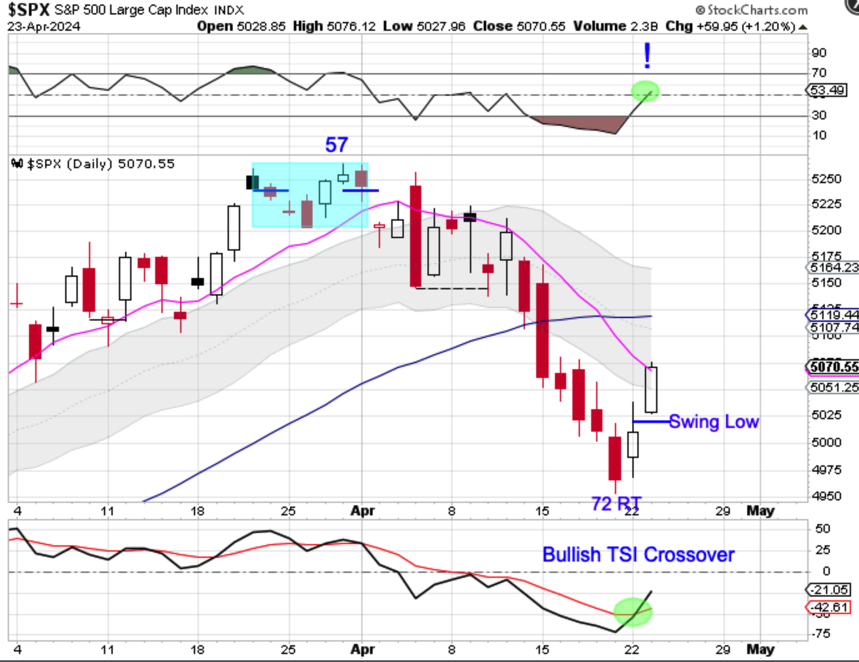

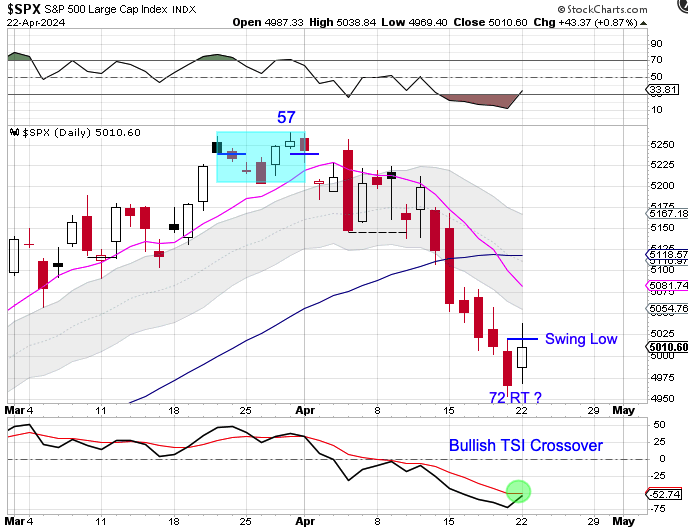

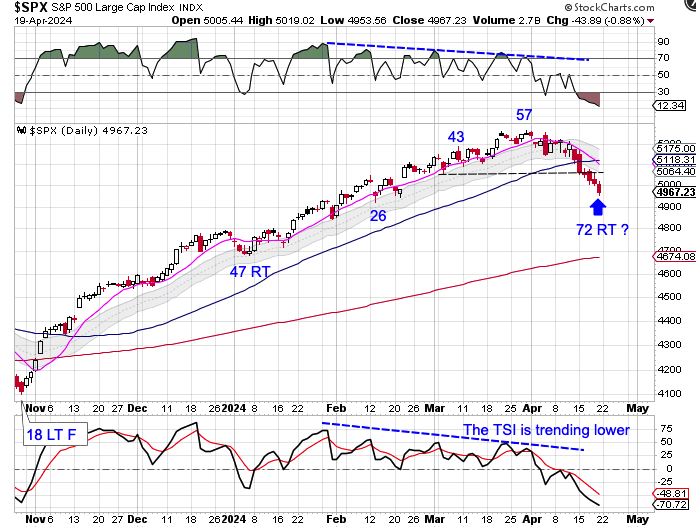

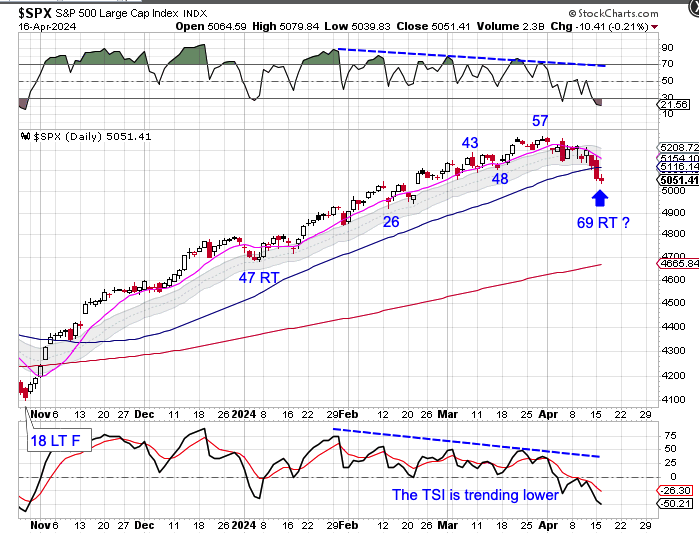

Stocks delivered bullish follow through on Friday confirming day 72 as the DCL. Stocks are now running into resistance at the 50 day MA. The decline into the day 72 DCL caused the 10 day MA to decline sharply, so stocks may need to consolidate to allow the 10 day MA to flatten out before it can turn higher. Stocks are currently in a daily downtrend. They will remain in their daily downtrend unless they close above the upper daily cycle band.

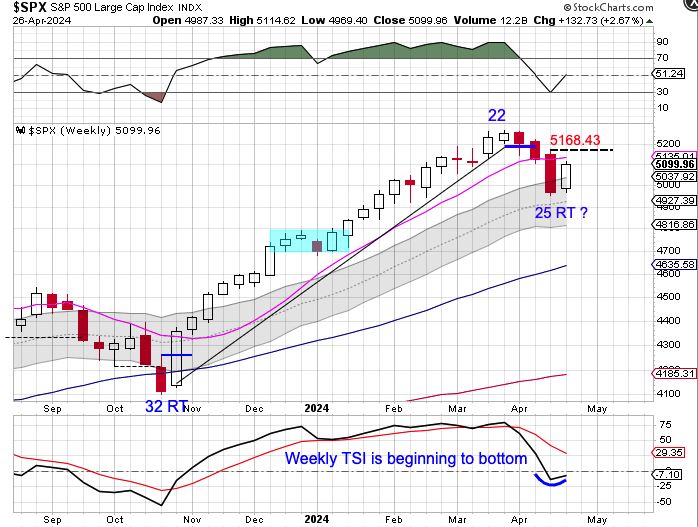

Stocks printed their lowest point on week 25, placing them in their timing band for an ICL. Stocks should turn the 10 week MA lower in order to complete their intermediate cycle decline — but that may not happen. In The Weekend Report I discuss an early signal that indicates the ICL has been set.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.